The average American adult has to pay 11 bills a month, which collectively means we pay some 15 billion bills, which adds up to nearly $4 trillion per year.

Aiming to help us manage this tangled mass of payments is the Palo Alto startup Pageonce, which has developed what its C.O.O. Steve Schultz calls a “remote control for your personal finances” that works on your smartphone, the web, or as of this week, an iPad.

Over the past month, Pageonce has added a secure bill pay option to its service, which sets it significantly apart from its main competitor in the online personal finance space, Mint.com.

In fact, the company, backed by $25 million in angel and VC funding, appears to be moving into more direct competition with banks and large billing sites, like those of the cable operators and cellphone carriers.

Pageonce works like this: You download the free app from the iTunes or Android store, open an account, and import your financial accounts – checking accounts, investments, as well as all of your bills, credit cards, etc.

“This allows us to link all of your financial accounts, connect up the dots, and help you see the patterns,” explains Schultz. “It’s all there at the tip of your fingers.”

The app displays various views, starting with an overview that shows how much cash and investments you currently have, as opposed to how many bills and credit card debt you owe.

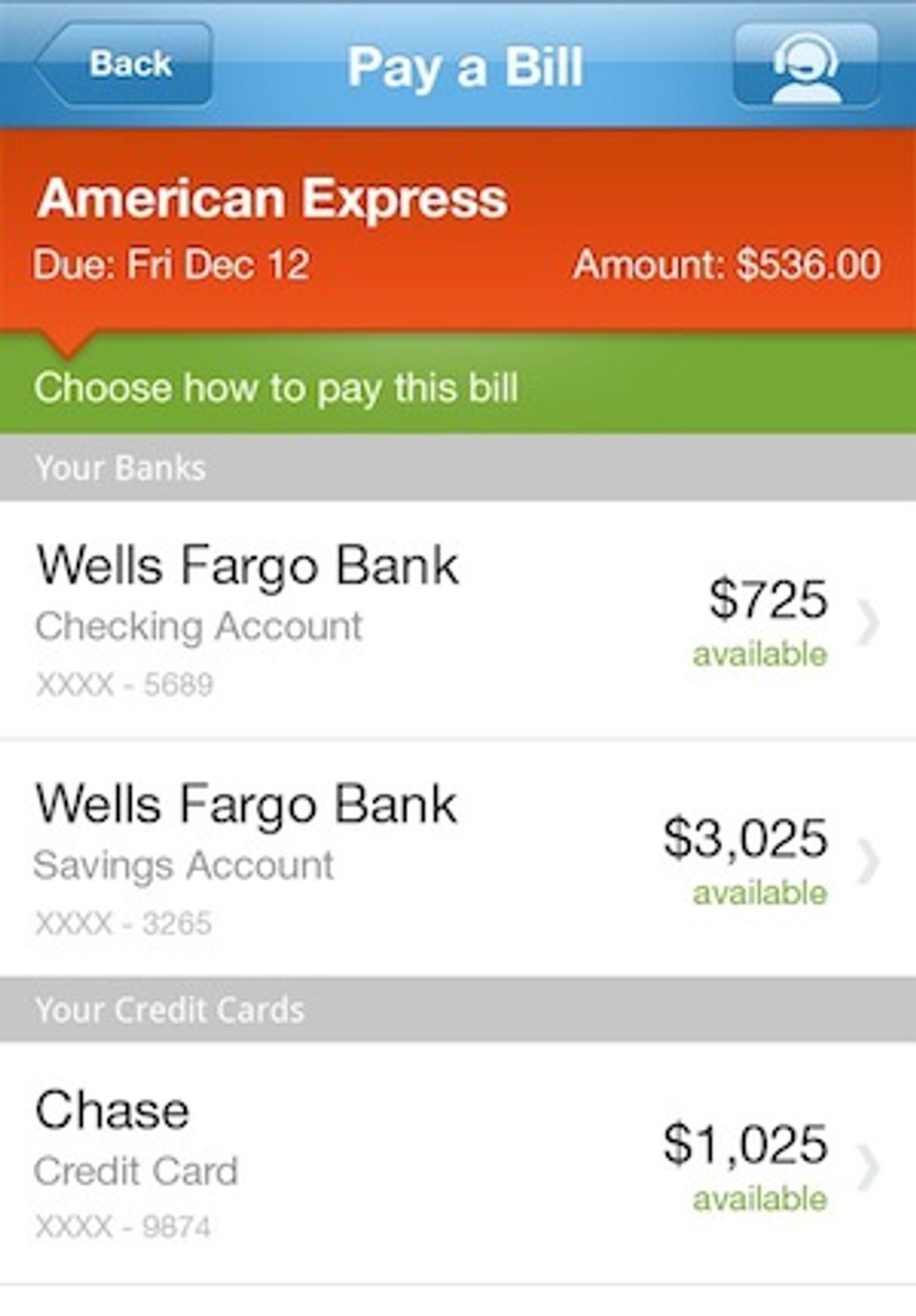

Using a color-coded system, the app alerts you as to which bills are due (or overdue) and which are coming up soon. It also allows you to make a one-click payment on any of them, drawing from any linked payment account you have in the system.

Once the payment has been concluded, the app informs you (and sends a receipt to your email address) and that bill falls to the bottom of your list.

“We set out to simplify what is a headache for most people,” notes Schultz.

The company’s research shows that 75 percent of Americans still use traditional methods to pay their bills, either with paper statements and checks and/or by paying at the billers’ physical sites or websites.

Surveys of users and focus groups by Pageonce further revealed that most people use multiple methods, including some online payments and some by phone, to manage their bill-flow.

When asked to describe this messy experience in just one word, the largest group of users chose that it “sucks.”

The Pageonce solution to link all your financial records is free, but to add the bill pay function will cost you $4.99/month. The company says it adheres to banking-level security standards with additional dedicated resources to preserve the safety and security of its customers’ transactions and financial information.